Find Your Perfect Home

Where Elegance Meets Opportunity

Find Your Perfect Home

Where Elegance Meets Opportunity

Discover Lifestyles

Discover Timeless Living. Find Your Perfect Home Today

Investment Opportunities

We bring you the finest investment opportunities from OmranTRK—featuring ready-to-move and under construction projects in prime locations, paired with flexible payment plans designed to suit your lifestyle and ambitions.

Cennet Yalova

Çamlık Mh. Hasan Baba Cd. Cennet Yalova Sitesi No.21, Çınarcık / Yalova- 50-311 m²

- Residential

Contact Us

Get a Free Consultation

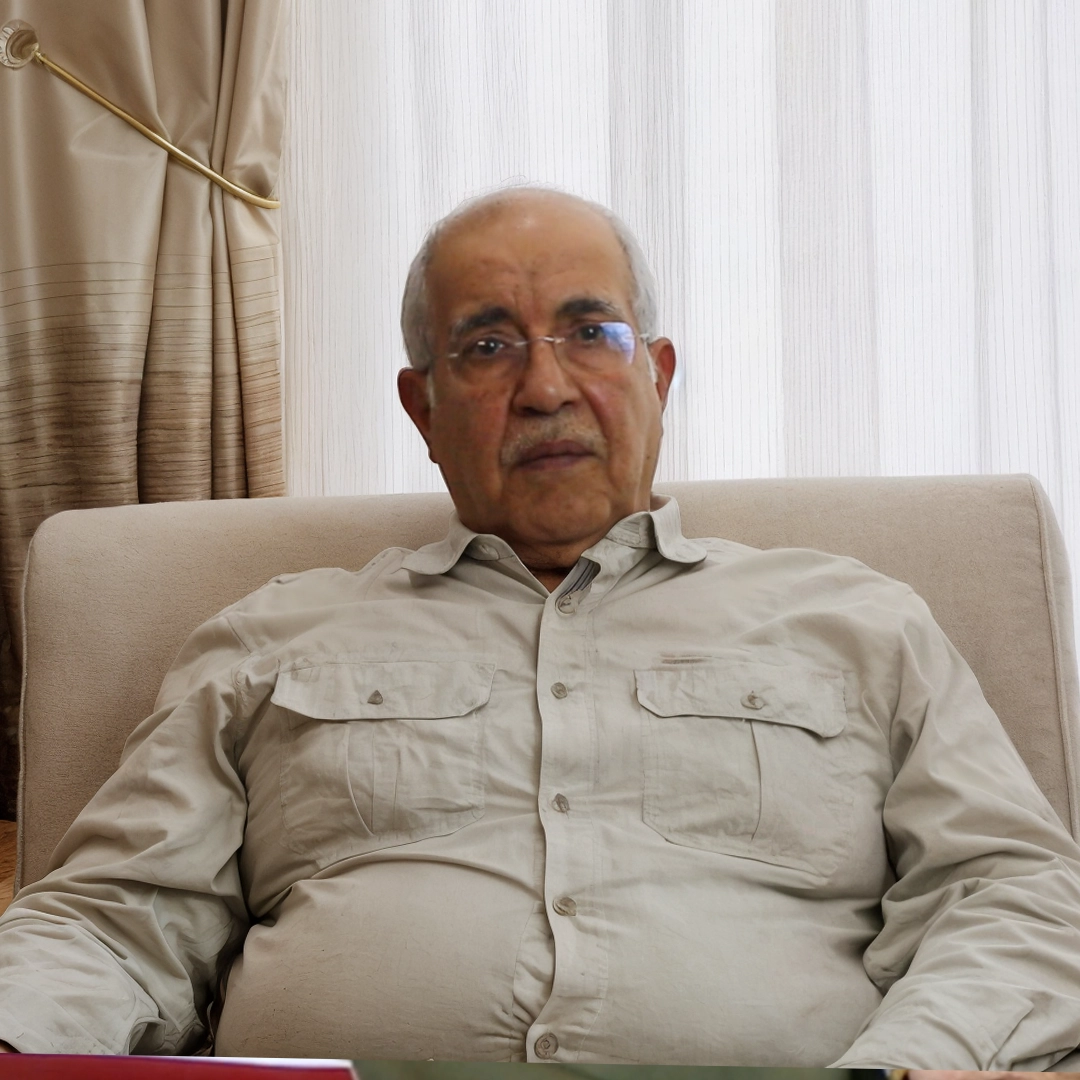

What customers are saying

Bahrain

Kuwait

Kuwait

Syria

Syria

Egypt

Why OmranTRK?

We take care of your investment and accompany you every step of the way

Our team delivers high-quality, competitive real estate services in Turkey’s property market.

We maintain a strong market presence driven by a renewed and ambitious vision.

Committed to achieving consistent annual growth while upholding the highest standards.

From your first contact to post-purchase support—residency, leasing, resale, title transfer, and more—we’re with you every step of the way.

Blog Posts

Stay Informed with the Latest Market Trends and Tips